Expertise Asia has posted almost 1,000 articles over the past 5 years. Interested readers have the option to contribute to the publication, as an acknowledgment of the value provided to them. Contributions do not commit the author to future production. Thank you for your continued support.

It is that time again, when the eurozone countries’ central banks report their monthly Target2 balances. Agreed, this is being covered quite excessively in this space, but there is a reason for it. Europe’s populist wave is not abating, and at one point sooner or later we will have an EU referendum in one of the eurozone nations. What the consequences of such a case will be, the Target2 divergence and related imbalances give us as sense of today.

So, the Bundesbank reported, how can it be different, an increase in their August receivables against the eurosystem by 17 billion Euros compared to July, to a new total of 678 billion. Year-on-year that number has surged by a jaw-dropping 116 billion! Undeterred we are moving towards the all-time positive balance of 751 billion at the height of the eurozone crisis in summer 2012. If the current pace is kept, we might surpass it by year end.

On the flip side of things the Banca d’Italia reported that Italy’s Target2 balance, as obviously liabilities, has already surpassed the previous record of 2012. Its August number soared by 35 billion and reached a new all-time high of 327 billion. I may have said this before, but we have never been here before. This is a new dimension of debt that Italians are meant to carry, on top of government, private enterprise and household debt.

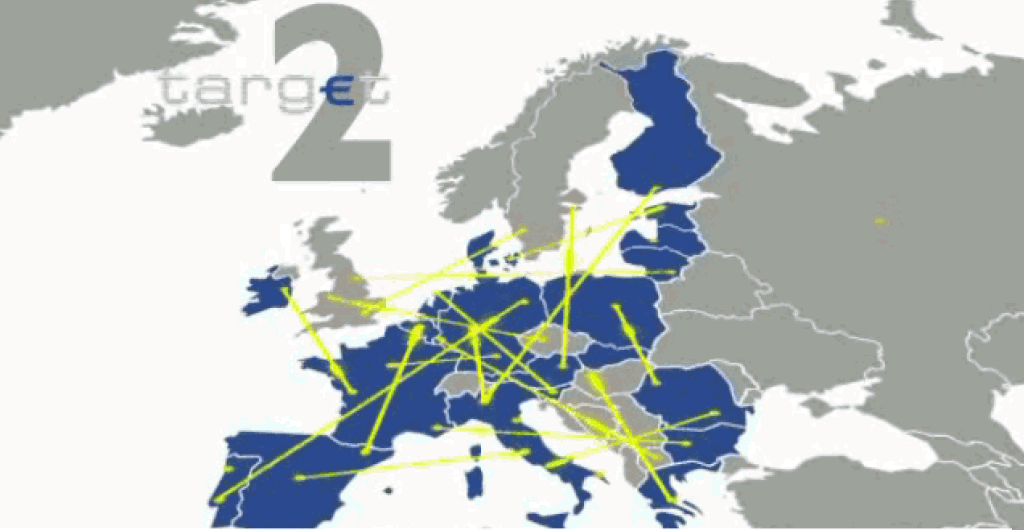

To remind ourselves, Target2 is an expression of the balance of payments between a country in the eurozone and the rest of the eurozone. As accounts always have to balance within the eurosystem, else the entire currency union would collapse, Target2 money flows that are entirely being facilitated by the ECB have the function of adjusting surplus and deficit countries.

Germany’s receivables are essentially most of the other eurozone countries’ liabilities. German surpluses are being migrated via the ECB, from the Bundesbank to the likes of Banca d’Italia leaving the German central bank with respective government bond collateral on the asset side of their balance sheet. What this means however is that Germany is stealthily lending Italy money to the tunes of a couple of hundred billion Euros, in addition to all other exposure.

Italy’s surge in eurosystem liabilities is interesting insofar, as the country has also been sporting healthy trade surpluses, which should theoretically trim their Target2 balance. In the first eight months the trade surplus has clocked up a respectable 25 billion Euros, yet the Target2 liabilities surged by 78 billion. The ugly truth is that private funds continue to leave for Germany, by way of capital flight.

Bundesbank money needs to replace them at the origin country. They are being channeled through the ECB system and booked as receivables. You do the math and will find that year-to-date an incredible 103 billion Euros must have departed from Italian banks to arrive at the numbers as they stand now. So much for people’s comfort to keep their savings within the Italian jurisdiction, namely none.

There is more oil in the fire. With Mario Draghi conducting massive QE and literally drowning his home country’s banking system with liquidity simply doesn’t lead to an increase of credit to the real economy but entices to buy financial and other assets in Germany. The divergence of the two countries’ Target2 balances is naturally being boosted higher. More liquidity means and enables more capital flight from the periphery to Germany.

But the higher balance is also being explained by the Northerners’ surplus madness. As long as Germany lives and dies by a surplus policy, including trade, capital and budget, periphery as well as France will by definition not be able to reduce their debt and Target2 liabilities. In the end, one country’s surplus mirrors another one’s deficit. And Target2 is the buffer.

That is how a currency union between 2 completely different saving patterns works. On one hand, Italy grabs its cash that is made available aplenty by the common central bank and moves it to perceived safety. On the other, Germany’s business model may be prudent, it just doesn’t fit in. Its surplus isn’t money in the bank, it is a bunch of receivables the credit worthiness of which is falling continuously.

It brings us back to the notion of Germanic and Latin Europe, one that has been debated in this space for years now. If Germany is unable to live up to the promise of going up in the bigger whole and adapt their teutonic virtues, the eventual exit of a eurozone country might become inevitable and destroy it.

The postings on this website are confidential and private. The material is provided to you solely for informational purposes and as a complimentary service for your convenience, and is believed to be accurate, but is not guaranteed or warranted by the author. It has not been reviewed, approved or endorsed by any financial institution or regulatory authority in your jurisdiction. It should not in any way be construed as investment advice and/or -recommendation of any kind, in any market and in any jurisdiction. The views expressed therein are none other than the author’s personal views. He is not responsible for any potential damages or losses arising from any use of this information. The reader agrees to these terms.