There is a major imbalance, roughly between the Western world as we know it, and the Asian and emerging world. And I don’t mean that in the context of deficit and surplus countries, or demographics, but with regards to the gold holdings at their respective central banks. While nations like America, France, Italy, and even Germany to some extent, drown in debt, they have considerable gold reserves at their disposal still.

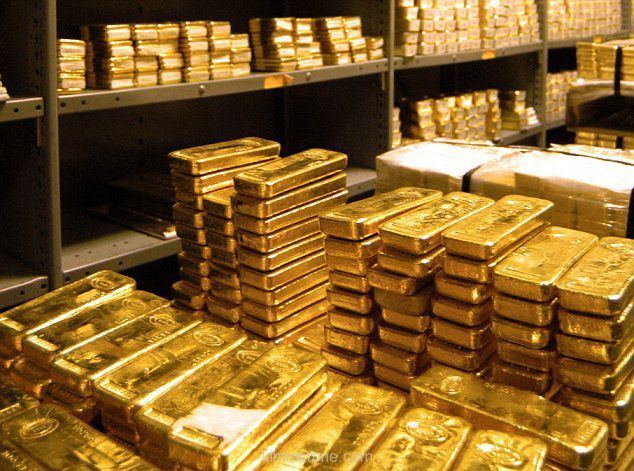

The US is obviously the world’s biggest holder of gold, with roughly 8,200 tonnes of the shiny metal stored in predominantly Fort Knox in Kentucky. At current prices this represents around 75% of the entire US foreign reserves. Germany is right behind America, with less than half of that, at 3,400 tonnes and that being 67% of their reserves. France and of all places Italy are next, with 2,500 tonnes each and mid 60s% of respective reserves.

Compared to this, the world’s surplus powerhouses look nothing but meagre. China you would have thought played at least in the European league, but no, their gold holdings have end of last year been reported to be a mere 1,840 tonnes. In relation to China’s vast reserves that is just over 2%! Japan is no better. It accounts for a very steady amount of 765 tonnes or 2.4% of their total.

Even gold-adoring India is only at 560 tonnes or 6.3% of reserves. This is obviously not counting the gold in private ownership across the country, and that has traditionally been sizeable. So you see what I am saying here. We are not talking about minor deviations. There is a massive difference how foreign reserves are being compiled between America and Europe on one hand, and Asia on the other.

It’s not that China hadn’t boosted its gold holdings, in 2009 from 600 to 1,000 tonnes, and in 2015 by a whopping 800 tonnes to over 1,800. The plan is certainly to pile up more of it in the vaults of Beijing. And to be sure, India had also stocked up significantly on its gold reserves in 2009, by 50% or 200 tonnes. You may remember that, when this action was widely publicised going into the financial crisis.

Even sanction-plagued Russia has been busy re-building their foreign reserves post that early 2015 drop from near 500 to 300 billion dollars. As the Russian central bank reported on Wednesday, Moscow slowly but steadily has lifted their reserves back up to 332 billion. The increases however are mostly and in a very discipline way being done by additions to 1,670 tonnes of gold that account for 17% of reserves now.

If the Western countries’ standard was anything to go by, then we are likely to be only at the beginning of a major shift. We know from comments out of the PBoC that China is keen to boost the share to gold. If they are seen doing it, others may jump on the bandwagon. This sounds like a tsunami of demand in the gold market that hasn’t shown any signs of such phenomenon yet. Its price keeps lingering between 1200 and 1250 dollars per ounce.

Of course, if Italy went downhill at one point, they might be left with a last option to lighten up on their considerable gold holdings. It has been suggested before, but this will certainly be last resort and is still far from even contemplation. So what is it about that gold? As far as I read it, interest is huge and catch-up by surplus and Asian countries to be done. It may at worst put a floor under gold’s price for quite some time to come.