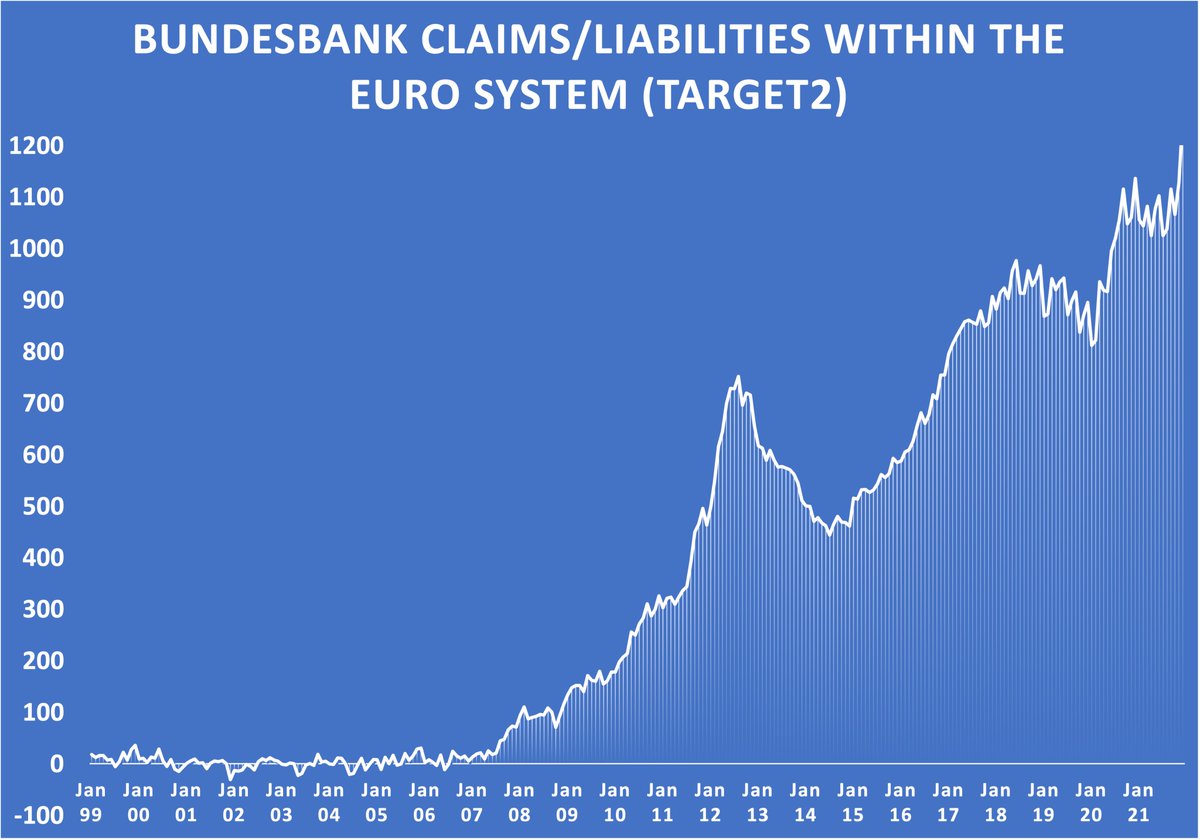

There is no ducking it. The German Bundesbank finally reported year-end numbers of Target2-related receivables on its balance sheet. Month-on-month the number surged by a whopping 133 billion Euros, and it is now up from the previous record balance of 1.14 trillion in December 2020, to a new total and all-time high of 1.26 trillion! Gone for good it seems are the days of sub-one trillion balances, and they might not come back. In short, Germany is simply on the hook for more than 1 1/4 trillion Euros.

I don’t need to remind readers of the Target mechanism’s significance, a pet project of mine for many years now. A German positive balance, ie the Bundesbank’s receivables vis-a-vis the eurosystem, is mirrored by predominantly Italy’s and Spain’s negative balances, ie liabilities versus the eurosystem. Surplus funds that arrive in Germany from the periphery, by way of current account and capital flight, must be recycled back into the origin countries by way of the ECB, or else the currency union would collapse.

The problem with the mechanism, and I have pointed this out countless times in this space, is not just the sheer size of the imbalance but that Germany’s receivables are with the ECB only and not fungible with any peripheral collateral, such as Italian and Spanish government bonds. So, in a sense, it is unsecured lending that will basically never be recoverable again. On the contrary, Germany has turned into a sitting duck waiting for peripheral debt to reach a point where a massive restructuring becomes inevitable.

When, not if we get to this scenario, the German taxpayer will be suffering a haircut on his and her national wealth. We cannot foretell to what magnitude, but we can be certain that it will not be the only debt restructuring. Consecutive exercises of this sort will stealthily nibble away at hard-earned teutonic assets. And the tragedy is that Germans won’t be able to do anything about it. As long as the periphery can threaten to exit the EU and implode Europe as a whole, who is to seriously argue against the occasional haircut?

We are talking about the outright destruction of German national wealth. It is mind-boggling that such prospect has successfully been concealed from the public. Over the past decade I haven’t heard any debate about this for all intents and purposes existential matter in the Bundestag, except maybe a half-hearted attempt by the outsider AfD party once, and it was certainly not raised during last year’s election campaign. Or try to google it, and you will find you have to dig deep at the Bundesbank website to extract the recent number.

Not even the new finance minister, the hawkish Christian Lindner from the liberal FDP, has spent any time or voiced an opinion on the Target2 issue. Sadly also that the leader of the opposition, the CDU’s new chair and this space’s darling politician Friedrich Merz, hasn’t taken up the baton as he should. Maybe the elite reckons that Germany is so deep-in already that any public attention to this monstrosity of an imbalance could spark a people’s revolt beyond the Covid rebellion.

Not enough with that. The ECB’s periphery-minded monetary policy, with Mario Draghi as well as Christine Lagarde, and the related asset purchases have manufactured quasi-zero interest rates for and to throw a lifeline to Europe’s ailing south, but it has also caused a German yield curve that has almost entirely remained in negative territory, despite rocketing inflation. Target2 is a testament to the fact that such disproportionate QE fuels the rotation of excess liquidity, or we might want to call it capital flight instead.

Of course, state-provided pensions will be modified and adapted so that the masses don’t feel a short- to medium effect. But in the end, it inevitably comes at the nation’s expense as transfer payments weigh on national budgets, the ones that have in any case been strained by the costs of the pandemic and will be stretched beyond by way of the climate policies of Berlin’s new coalition government. Net-net, the long-term financial implications can only turn for the worse.

Not all of them suffer, to be sure. The wealthy and privileged have long figured out how to play the game. They are benefitting from this anomaly by investing in stocks and property, both of which have hit all-time highs. It is the wider society suffering, however, as they in their once imperturbable belief in the Bundesbank’s virtuous monetary policy never bought but rented homes and saved in deposits and bonds. Latin Europe has prevailed over Germanic Europe, and as a result we have slipped into financial repression.

We also know well that financial repressions cause steeper social curves and millions of losers in previously egalitarian and harmonious societies. People instinctively sense the creeping impoverishment, and there is a reason why populism has generally been on the rise across the Old Continent. We have likely not seen the end of it. The German population is still sleeping at the wheel, and their own politicians are seemingly doing their utmost to keep the truth under the carpet.