You may have picked up on that article in the FT last night. It is a rare occasion that Mario Draghi’s succession at the ECB is debated in so much detail. After all, he will still remain at the helm until late 2019. But we are increasingly getting a sense that the run for this most crucial job in Europe has commenced. So far, it has widely been speculated, or even assumed, that it will finally be time for a German to take the reign, and who better suited than the current head of the Bundesbank, Jens Weidmann.

There is no reason to take it away though. After the most unprecedented monetary easing of a global central bank, apart from Japan maybe, it will be an incredibly delicate task to manage rates policy and this mother of all bloated balance sheets. It is obvious to stakeholders that a German candidate, a hawkish one like Weidmann for that matter, would reverse material aspects of the prevailing course. The levels of concern have been rising and voices audible that put a Weidmann nomination in question.

It should come as quite a surprise to German readers that, according to the article, the Berlin government isn’t exactly lobbying to land that job. There are too many balls in the air, such as who will take the job of Commission president, how much an EU reform drive will be exerted etc. The fear in France, Italy, and Spain is that a German ECB head will be an obstacle to everything from more economic union to greater risk sharing to continuing to provide a lifeline for the periphery.

What has transpired is fear in Germany that the political price for the ECB job may be too high. Naturally, there will be a massive bargaining for jobs and influence. The French have taken the lead with the anti-Weidmann rhetoric. Sources close to Emmanuel Macron let it be known that they will not accept him. Finance minister Le Maire was reportedly a little more subtle by saying that Paris is far from convinced that a German ECB presidency is a done deal. Other EU officials have rejected Weidmann outright.

It very much reminds of the year 2011, when then-Bundesbank chief Axel Weber abruptly resigned from his post to preempt the indignity of being passed over for the nomination to succeed Jean-Claude Trichet. Up to that point, it had been expected that he’d be nominated as the incoming ECB chair and supported by Angela Merkel. Discouraged that the political machinery succinctly sacrificed him made Weber plunk his job, turn his back on Germany and take up the chairmanship at UBS.

Is Weidmann in for a similar fate? He is certainly seen as the revolutionary among council members. Will Merkel hesitate to support him because she can no longer assert herself vis-a-vis heavyweights such as Macron, or domestically in light of an empowered coalition partner, or for the benefit of another political horse trade? Merkel has been significantly weakened in the wake of this recent election quagmire. It may well be one of her final litmus tests before she ultimately hands over the reign in Berlin.

If German mythology was any guide, it would not look good. I can’t help but be reminded of my previous analogy of Germany’s post-War and modern history with the Nibelung trilogy that I

referenced numerous times in this space. The country is in the midst of a tragedy unfolding that is reflected in Richard Wagner’s works. Or shall we say tragedy has historically always been bestowed on the German people, it just plays out a different act with different protagonists.

In the Ring of the Nibelungs the Norse god Wotan’s mission is to build Valhalla, and for that purpose, he needs the giants. In order to pay them, he hands over the magic ring of the Nibelung treasure. Now substitute Wotan with Helmut Kohl, whose modern version of Valhalla was to have reunified Germany go up in the whole of Europe but preserve teutonic values without the German nation-state. I guess Wotan represents the entirety to the 1950s generation scarred by the War and forever rejecting national aspirations.

The giants to help build Valhalla are the other EU nations. The magic ring symbolises Kohl’s surrender of the Deutschmark at the altar of the eurozone. Francois Mitterrand tricked Kohl into monetary dependency without granting him the teutonic virtues Valhalla was meant to represent. The political meddling with the Euro has long done away with those, ie Maastricht and the concept of a stable currency. Wotan alias Kohl and his successors were all of a sudden ruled by laws they could no longer make and to which they themselves were bound.

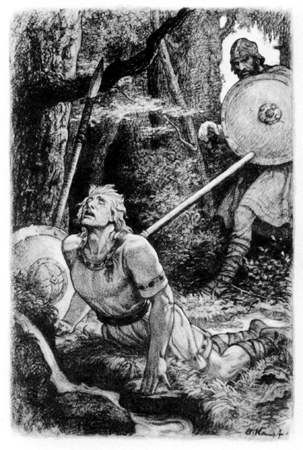

In the Ring, it took for grandson Siegfried to break the spell and get the ring back. It is simply too tempting to see blond-haired Jens Weidmann in that role, and taking the ring back resembles taking control of the ECB and restore a policy of teutonic virtues. The giants however are neck-deep in benefitting and enjoying their reward for accepting identity-stricken Germany into the EU, so much so that they cannot accept Siegfried to have his way. One of their vassals, Hagen, is contracted go and stab Siegfried in the back.

So again, if German mythology was any guide to the future, then I’d say it looks dire, for Weidmann and the German people. He’d obviously not literally get stabbed in the back but eliminated by political means, keeping him away from the ECB keys and preventing him from achieving his objective, namely preside over a monetary policy that fairly protects all taxpayers, but also the German. And make no mistake about it, the latter ones need every protection they can get, more than ever.

Have you seen the latest Target2 numbers for Germany? In February the positive balance soared to a new all-time high of 914 billion Euros. That is higher by 32 billion from January and by a whopping 99.6 billion from February last year. The vertical nature of this move is unmistakable. It is only a matter of time before this reading exceeds 1 trillion. The German people would tremble before this number, were they only more aware of it and its meaning.

Again, to remind ourselves, these are Bundesbank receivables versus the ECB, the bank implicitly holding government bonds of the peripheral eurozone in exchange for Germany funneling back surpluses to deficit countries. In other words, the Bundesbank is piling up foreign assets that aren’t fungible and might to a large part be irrecoverable. Years of German current account deficits would be required to claw back some sort of economic consideration, which is not a realistic scenario.

But what is the solution? If the ECB were to stop asset purchases, as continuously being demanded by Weidmann, the periphery’s lifeline would be cut, interest rates spiral up and the ballooning debt mountains no longer sustainable. If as a result a heavyweight like Italy were to exit the eurozone, Europe would be certain to disintegrate and the write-down on the Bundesbank receivables unfathomable as well as an incredible chunk of German wealth destroyed.

So, the only way to sort of save the day is for Germany to bite the bullet on the so far rejected mutualisation of debt in return for quasi-fiscal sovereignty over the eurozone, in alignment with such sovereignty over monetary policy. This may be the last chance to bring Europe back to where it was meant to be in the first place, as in one fiscal policy in the teutonic image for all, one constitution and legal system, and an effective dissolution of the nation-state on the Old Continent.

Yes, this still sounds like utopia. Weidmann may be the man up for the job, but rather than bearing the cost in righting the ship the giants will resort to the easier option, making sure no Weidmann ever gets the chance to take the ring back. Hagen is sharpening his spear as we speak.